Is a Newly Built Home Right for You? The Pros and Cons.

When searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible benefits. Talking to your agent is the best way to see if this type of home makes sense for you.

Here’s a quick rundown of some things your agent will walk you through – including a few of the top perks of buying a newly built home today and some potential things you’ll want to think about before you ink any contracts.

The Perks of Buying a Newly Built Home

Customization Options: Many builders allow buyers to choose finishes, layouts, and upgrades so that you can personalize your home to your unique sense of style. This is obviously more of a draw if the home is still under construction, but sometimes you can have a builder agree to some tweaks even after it’s completed.

Less Maintenance and Fewer Repairs: Everything from the roof to the appliances is brand new, which should save you on any upfront maintenance or repair costs — for at least the first few years. Many builders also offer warranties on things like structural components and major systems, to give you extra peace of mind. And not having to worry about this sort of thing is a big perk when everything feels so expensive right now.

Eco-Friendly and Energy-Efficient Features: With stricter building codes, newly built homes tend to be more environmentally friendly. This can include energy-efficient upgrades like smart thermostats and high-efficiency HVAC systems or eco-friendly tech. And all of these features can save you money on your future energy bills – again a welcome relief while inflation is stubbornly high.

Builder Incentives: Some builders are also offering incentives to homebuyers. While this will vary by builder, it could include rate buy-downs or other ways to offset today’s affordability challenges. As Bankrate says:

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.”

Other Considerations When Buying a Newly Built Home

On the other side of the coin, there are some things that you’ll want to at least consider before making your choice.

Longer Timelines: If you’re purchasing a home that’s still under construction, you may have to wait several months — or longer — before you can move in. As Realtor.com puts it:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

Potential Price Changes: Keep an eye on costs, too. It’s easy to go over budget if you keep tacking on upgrades or add-ons as you customize your build. At the same time, building materials, like lumber, can be affected by the economy, inflation, and changing trade policies. And unfortunately, if the cost of supplies climbs, builders will pass at least some of that increase on to people like you. As HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Bottom Line

New builds can be a great choice today, but you want to be sure you have all the information you need to make an informed decision on such a big purchase. To weigh the pros and cons, connect with a local agent.

Would you consider a newly built home? Why or why not?

And

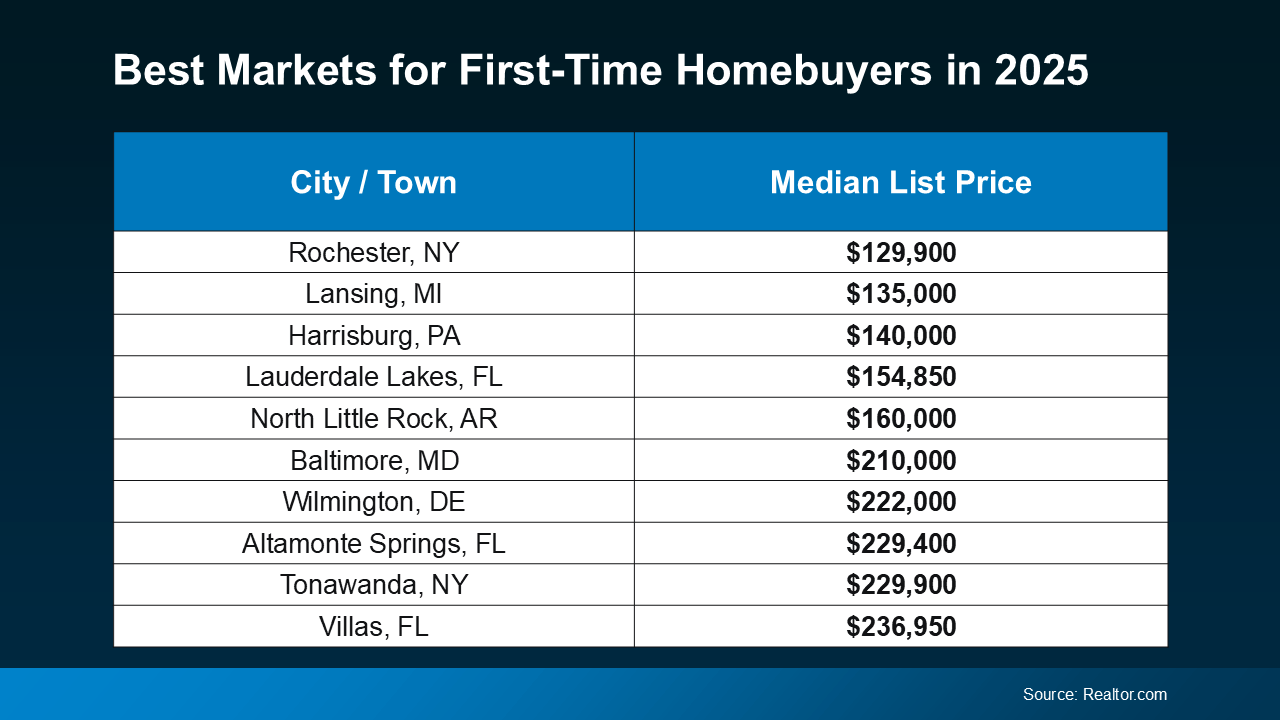

And

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.

Of course, moving to a different state isn’t for everyone – and isn’t a necessity. The right agent can help you find more cost-effective options wherever you are.