Lending Standards Are Not Like They Were Leading Up to the Crash.

You might be worried we’re heading for a housing crash, but there are many reasons why this housing market isn’t like the one we saw in 2008. One of which is how lending standards are different today. Here’s a look at the data to help prove it.

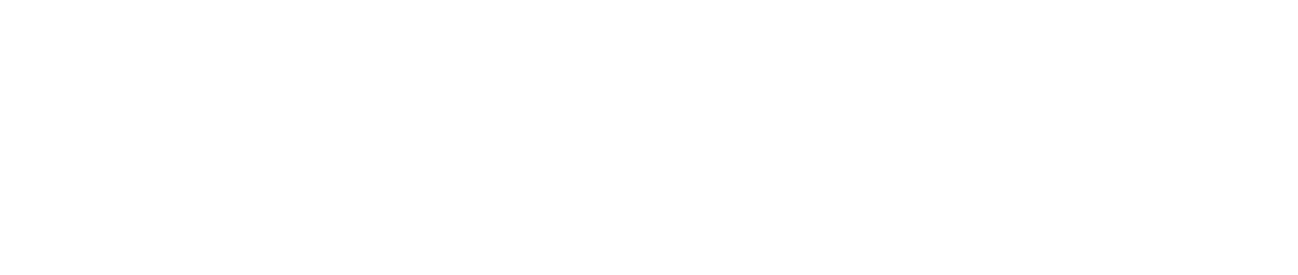

Every month, the Mortgage Bankers Association (MBA) releases the Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is . . . a summary measure which indicates the availability of mortgage credit at a point in time.”

Basically, the index determines how easy it is to get a mortgage. Take a look at the graph below of the MCAI since they started keeping track of this data in 2004. It shows how lending standards have changed over time. It works like this:

- When lending standards are less strict, it’s easier to get a mortgage, and the index (the green line in the graph) is higher.

- When lending standards are stricter, it’s harder to get a mortgage, and the line representing the index is lower.

In 2004, the index was around 400. But, by 2006, it had gone up to over 850. Today, the story is quite different. Since the crash, the index went down because lending standards got tighter, so today it’s harder to get a mortgage.

Loose Lending Standards Contributed to the Housing Bubble

One of the main factors that contributed to the housing bubble was that lending standards were a lot less strict back then. Realtor.com explains it like this:

“In the early 2000s, it wasn’t exactly hard to snag a home mortgage. . . . plenty of mortgages were doled out to people who lied about their incomes and employment, and couldn’t actually afford homeownership.”

The tall peak in the graph above indicates that leading up to the housing crisis, it was much easier to get credit, and the requirements for getting a loan were far from strict. Back then, credit was widely available, and the threshold for qualifying for a loan was low.

Lenders were approving loans without always going through a verification process to confirm if the borrower would likely be able to repay the loan. That means creditors were lending to more borrowers who had a higher risk of defaulting on their loans.

Today’s Loans Are Much Tougher To Get than Before

As mentioned, lending standards have changed a lot since then. Bankrate describes the difference:

“Today, lenders impose tough standards on borrowers – and those who are getting a mortgage overwhelmingly have excellent credit.”

If you look back at the graph, you’ll notice after the peak around the time of the housing crash, the line representing the index went down dramatically and has stayed low since. In fact, the line is far below where standards were even in 2004 – and it’s getting lower. Joel Kan, VP and Deputy Chief Economist at MBA, provides the most recent update from May:

“Mortgage credit availability decreased for the third consecutive month . . . With the decline in availability, the MCAI is now at its lowest level since January 2013.”

The decreasing index suggests standards are getting much tougher – which makes it clear we’re far away from the extreme lending practices that contributed to the crash.

Bottom Line

Leading up to the housing crash, lending standards were much more relaxed with little evaluation done to measure a borrower’s potential to repay their loan. Today, standards are tighter, and the risk is reduced for both lenders and borrowers. This goes to show, these are two very different housing markets, and this market isn’t like the last time.